The Definitive Guide to Getting a Personal Loan with Bad Credit

페이지 정보

작성자 Kermit 작성일 25-01-14 04:09 조회 22 댓글 0본문

Having bad credit could make it troublesome to get a personal mortgage. Your credit rating is among the most essential elements lenders think about when evaluating a mortgage application. If you have bad credit, it could really feel like you're stuck in a catch-22—you need a mortgage to improve your credit score rating, however lenders will not approve you for a loan due to your bad credit. Fortunately, there are ways to get a personal mortgage with unfavorable credit ratings.

What Is a Personal Loan?

A private loan is a sort of loan that's issued by a financial institution or different financial institution. It can be utilized for quite so much of purposes, such as consolidating debt, paying for home repairs, medical bills, or another expense that requires a lump sum of cash. Personal loans are usually unsecured, which means they do not require collateral, similar to a automobile or house, to be accredited.

How Does Bad Credit Affect Your Ability to Get a Personal Loan?

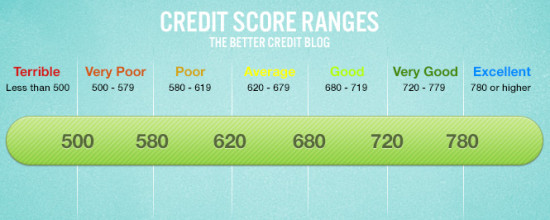

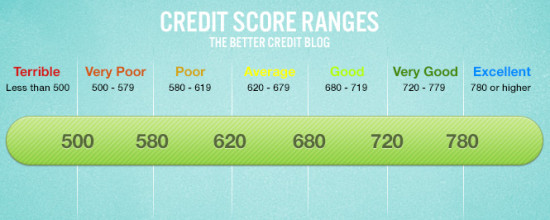

When you apply for a private loan, lenders will check your credit score. The larger your credit score score, the more doubtless you would possibly be to be permitted for a loan. If you've unfavorable credit ratings, it could be tough to get approved for a mortgage, as lenders could view you as a risk.

Tips for Getting a Personal Loan with Bad Credit

1. Improve Your Credit Score

The first step in getting a private mortgage with poor Cote de crédit : 5 astuces pour booster votre cote Financière credit is to improve your credit score rating. This could be carried out by paying down present debt and ensuring to make all payments on time. You can even verify your credit score report for any errors which may be negatively affecting your rating.

2. Look for Alternative Lenders

If you have unfavorable credit score ratings, it may be difficult to get accredited for a loan from a conventional lender. Thankfully, there are various lenders that specialize in approving loans for folks with unfavorable credit ratings. These lenders might offer lower rates of interest and extra flexible compensation terms than traditional lenders.

3. Get a Co-Signer

Another possibility for getting a personal loan with poor credit is to get a co-signer. A co-signer is somebody who agrees to tackle the accountability of repaying the mortgage in case you are unable to. This might help enhance your possibilities of getting accredited for a loan, because the lender will view the co-signer as a supply of security.

4. Look for Secured Loans

Secured loans are loans that require collateral, corresponding to a car or house, in order to be approved. If you could have unfavorable credit score ratings, that is another option to consider when applying for a mortgage. The collateral may help the lender really feel more secure in approving your mortgage.

Conclusion

Getting a personal mortgage with bad credit can be challenging, but it's potential. Improving your credit rating, in search of different lenders, getting a co-signer, Cote de crédit : 5 astuces pour booster votre cote financière and in search of secured loans are all potential choices to think about. With the right approach, you can get the loan you want, even when you have poor credit.

Getting a personal mortgage with bad credit can be challenging, but it's potential. Improving your credit rating, in search of different lenders, getting a co-signer, Cote de crédit : 5 astuces pour booster votre cote financière and in search of secured loans are all potential choices to think about. With the right approach, you can get the loan you want, even when you have poor credit.

What Is a Personal Loan?

A private loan is a sort of loan that's issued by a financial institution or different financial institution. It can be utilized for quite so much of purposes, such as consolidating debt, paying for home repairs, medical bills, or another expense that requires a lump sum of cash. Personal loans are usually unsecured, which means they do not require collateral, similar to a automobile or house, to be accredited.

How Does Bad Credit Affect Your Ability to Get a Personal Loan?

When you apply for a private loan, lenders will check your credit score. The larger your credit score score, the more doubtless you would possibly be to be permitted for a loan. If you've unfavorable credit ratings, it could be tough to get approved for a mortgage, as lenders could view you as a risk.

Tips for Getting a Personal Loan with Bad Credit

1. Improve Your Credit Score

The first step in getting a private mortgage with poor Cote de crédit : 5 astuces pour booster votre cote Financière credit is to improve your credit score rating. This could be carried out by paying down present debt and ensuring to make all payments on time. You can even verify your credit score report for any errors which may be negatively affecting your rating.

2. Look for Alternative Lenders

If you have unfavorable credit score ratings, it may be difficult to get accredited for a loan from a conventional lender. Thankfully, there are various lenders that specialize in approving loans for folks with unfavorable credit ratings. These lenders might offer lower rates of interest and extra flexible compensation terms than traditional lenders.

3. Get a Co-Signer

Another possibility for getting a personal loan with poor credit is to get a co-signer. A co-signer is somebody who agrees to tackle the accountability of repaying the mortgage in case you are unable to. This might help enhance your possibilities of getting accredited for a loan, because the lender will view the co-signer as a supply of security.

4. Look for Secured Loans

Secured loans are loans that require collateral, corresponding to a car or house, in order to be approved. If you could have unfavorable credit score ratings, that is another option to consider when applying for a mortgage. The collateral may help the lender really feel more secure in approving your mortgage.

Conclusion

Getting a personal mortgage with bad credit can be challenging, but it's potential. Improving your credit rating, in search of different lenders, getting a co-signer, Cote de crédit : 5 astuces pour booster votre cote financière and in search of secured loans are all potential choices to think about. With the right approach, you can get the loan you want, even when you have poor credit.

Getting a personal mortgage with bad credit can be challenging, but it's potential. Improving your credit rating, in search of different lenders, getting a co-signer, Cote de crédit : 5 astuces pour booster votre cote financière and in search of secured loans are all potential choices to think about. With the right approach, you can get the loan you want, even when you have poor credit.- 이전글 Learn To Communicate Robot Vac To Your Boss

- 다음글 Will Mesothelioma Asbestos Lawyers Always Rule The World?

댓글목록 0

등록된 댓글이 없습니다.